Category: Financial Reporting

-

What You Need to Know About Cryptocurrency Accounting Errors – Part 4

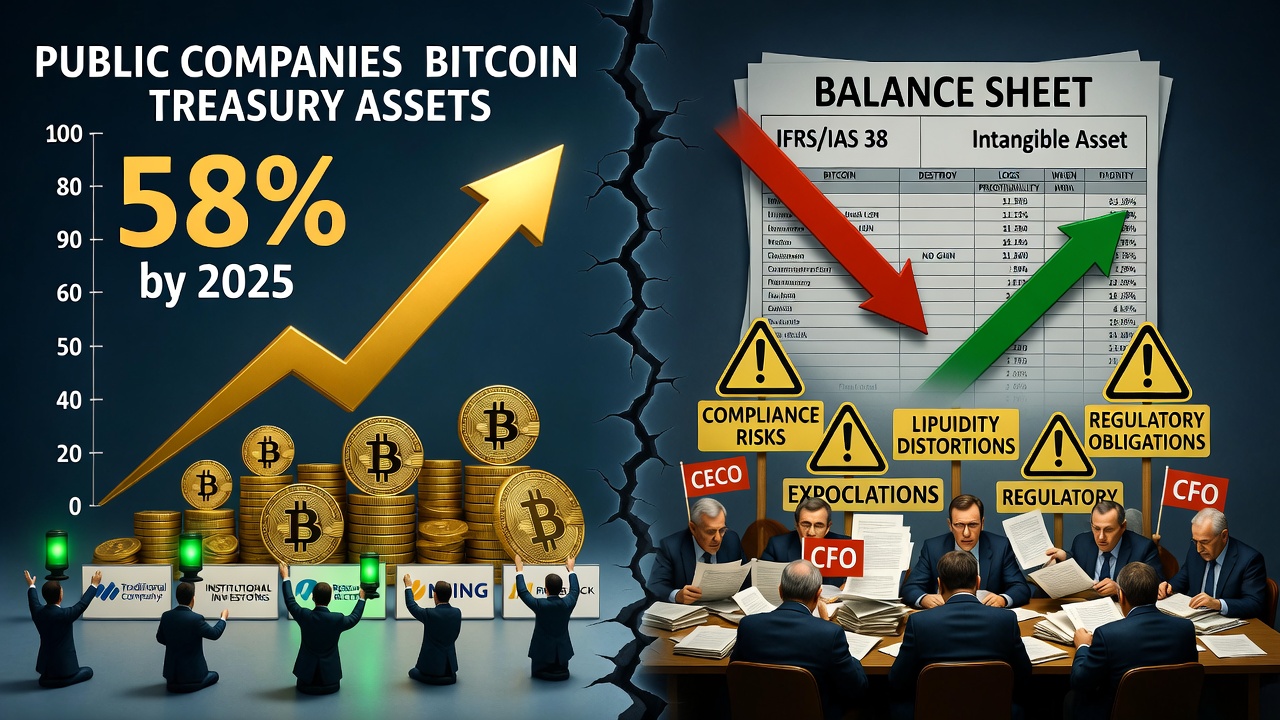

Cryptocurrency accounting under IAS 38: why intangible asset classification fails, measurement limitations, and emerging pressure for IFRS change.

Written by

-

What You Need to Know About Cryptocurrency Accounting Errors – Part 3

Cryptocurrency accounting errors under IAS 2 can distort mining financials. Learn when digital assets qualify as inventory vs. intangible assets under IFRS.

Written by

-

What You Need to Know About Cryptocurrency Accounting Errors – Part 2

Critical cryptocurrency accounting errors costing exploration firms millions. Learn proper Bitcoin classification under IFRS IAS 7.

Written by

-

What You Need to Know About Cryptocurrency Accounting Errors – Part 1

Navigate cryptocurrency accounting IFRS standards for exploration companies. Bitcoin holdings, financial reporting challenges, and TSX compliance explained.

Written by

-

Impairment Testing for Exploration and Evaluation Assets

According to PwC’s Mine 2023 report, the world’s top 40 mining companies recorded impairment charges of $16.1 billion in 2022, highlighting the critical importance of proper impairment testing for mining assets. In this comprehensive guide, we’ll dive into the intricate world of exploration and evaluation (E&E) asset impairment testing, ensuring your company stays compliant while…

Written by

-

Complete Guide to Disclosure Requirements for Exploration and Evaluation Expenditures

The mining industry represents a cornerstone of the Canadian economy, with the Toronto Stock Exchange (TSX) and TSX Venture Exchange being home to over 1,100 mining and mineral exploration companies! For these public companies, proper disclosure of exploration and evaluation (E&E) expenditures isn’t just a regulatory requirement—it’s fundamental to maintaining investor confidence and market integrity.…

Written by

-

Accounting for Joint Ventures in Mineral Exploration Projects

In the ever-evolving world of mineral exploration, joint ventures have become a prevalent business structure, with recent industry data suggesting that over 60% of major projects worldwide are now organized in this manner. This significant statistic underscores the critical importance of adept accounting practices in managing these joint ventures. The financial intricacies involved require a…

Written by

-

Valuation of Mineral Rights and Reserves under IFRS

In the field of financial reporting for mineral exploration and mining operations, accurate valuation of mineral rights and reserves is paramount. For Canadian public companies, navigating these complexities is essential to ensure compliance with International Financial Reporting Standards (IFRS) and to present a transparent financial position to stakeholders.

Written by

-

Capitalizing vs. Expensing Exploration Costs: Best Practices

Navigating the complexities of financial reporting for mineral exploration companies under IFRS is essential for maintaining transparency and fiscal health. The choice between capitalizing and expensing exploration costs can significantly influence a company’s financial outcomes and strategic direction. This article explores the best practices tailored to Canadian public companies, providing insights into making informed decisions.

Written by