Tag: Reporting

-

What You Need to Know About Cryptocurrency Accounting Errors – Part 5

Master cryptocurrency accounting IFRS 13 disclosure requirements and fair value measurement for mining companies holding digital assets.

Written by

-

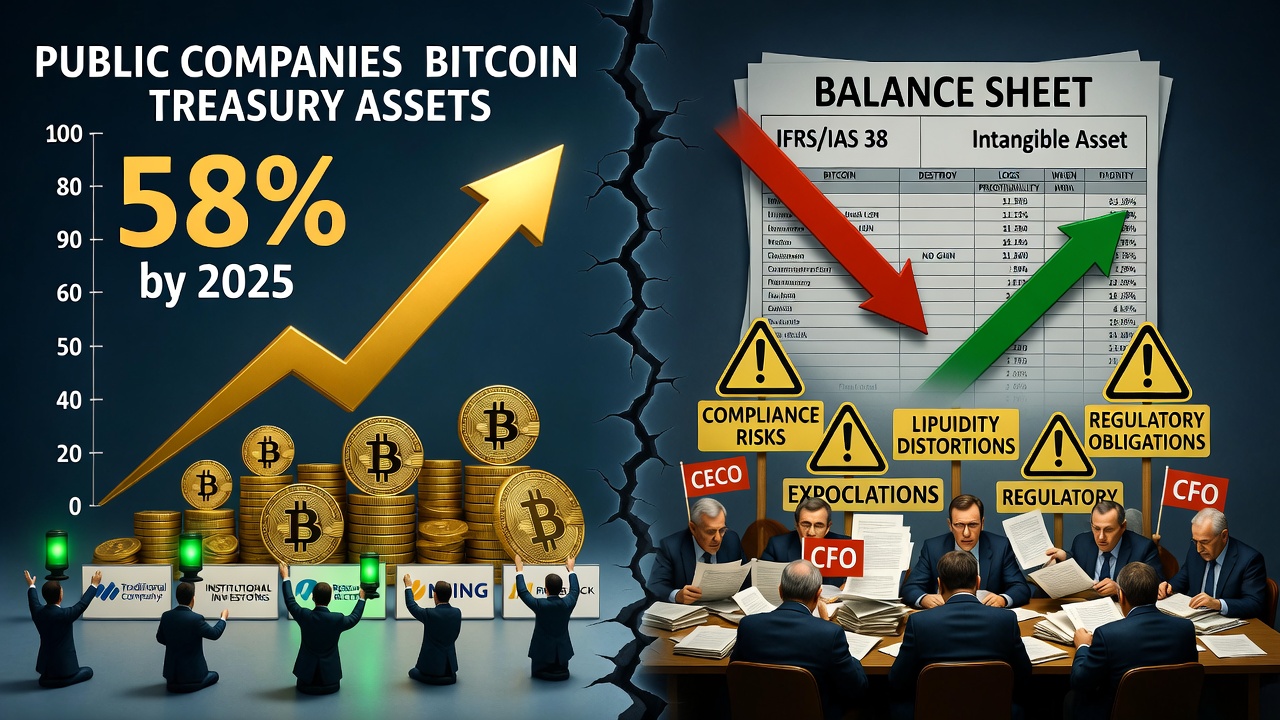

What You Need to Know About Cryptocurrency Accounting Errors – Part 4

Cryptocurrency accounting under IAS 38: why intangible asset classification fails, measurement limitations, and emerging pressure for IFRS change.

Written by

-

What You Need to Know About Cryptocurrency Accounting Errors – Part 3

Cryptocurrency accounting errors under IAS 2 can distort mining financials. Learn when digital assets qualify as inventory vs. intangible assets under IFRS.

Written by

-

What You Need to Know About Cryptocurrency Accounting Errors – Part 2

Critical cryptocurrency accounting errors costing exploration firms millions. Learn proper Bitcoin classification under IFRS IAS 7.

Written by

-

What You Need to Know About Cryptocurrency Accounting Errors – Part 1

Navigate cryptocurrency accounting IFRS standards for exploration companies. Bitcoin holdings, financial reporting challenges, and TSX compliance explained.

Written by

-

Critical Minerals Flow-Through Incentives: Capturing Enhanced Benefits for Strategic Resources

#4 Discover how Canadian mining executives are transforming flow-through financing results by mastering the enhanced 30% Critical Minerals Exploration Tax Credit. This comprehensive guide reveals why traditional metal explorers may already have access to superior CMETC benefits through natural geological associations, and shows exactly how to evaluate, structure, and communicate these opportunities for premium pricing.…

Written by

-

Strategic Timing: Balancing December Premiums Against Operational Reality

#2 Discover why December flow-through raises command 25% premiums but create the highest compliance risks, and learn strategic alternatives that optimize capital deployment across Canada’s diverse exploration seasons. This comprehensive timing guide reveals how seasonal constraints, investor tax cycles, and regional variations can make or break your flow-through execution, with frameworks for multi-phase program planning…

Written by

-

Flow-Through Fundamentals: What Canadian Mining Executives Need to Know in 2025

#1 Master the regulatory foundation of Canadian flow-through financing that powers 65% of exploration capital. This essential guide breaks down CRA compliance requirements, eligibility criteria, and strategic decision-making frameworks that separate successful flow-through programs from compliance disasters. Learn why understanding CEE versus CDE classifications, recent regulatory changes, and timing considerations can mean the difference between…

Written by

-

How To Use AI to Provide Proactive Financial Oversight for Your Business in 2025

Discover how AI transforms financial oversight for businesses in 2025. Learn practical strategies and insights for proactive management, risk mitigation, and compliance.

Written by

-

How AI Can Streamline Expense Reporting for Canadian Businesses in 2025

Discover how AI streamlines expense reporting for Canadian businesses with automation, compliance, and efficiency. Expert insights for 2025.

Written by